Frontend-as-a-Service in insurance: why firms are ditching custom web development in search of competitive advantage

To maintain a competitive advantage in the congested consumer insurance market, brands are evaluating their digital offering and tech stack. Customer experience is rapidly becoming a core KPI, and indications are that insurers are investing heavily in new technologies in pursuit of effortless service delivery.

The global InsureTech market size is set to achieve a staggering $166.4 billion by 2030, growing at a rapid 39.1% CAGR. This growth will be driven by consumer demand for transparency and first-class digital experiences.

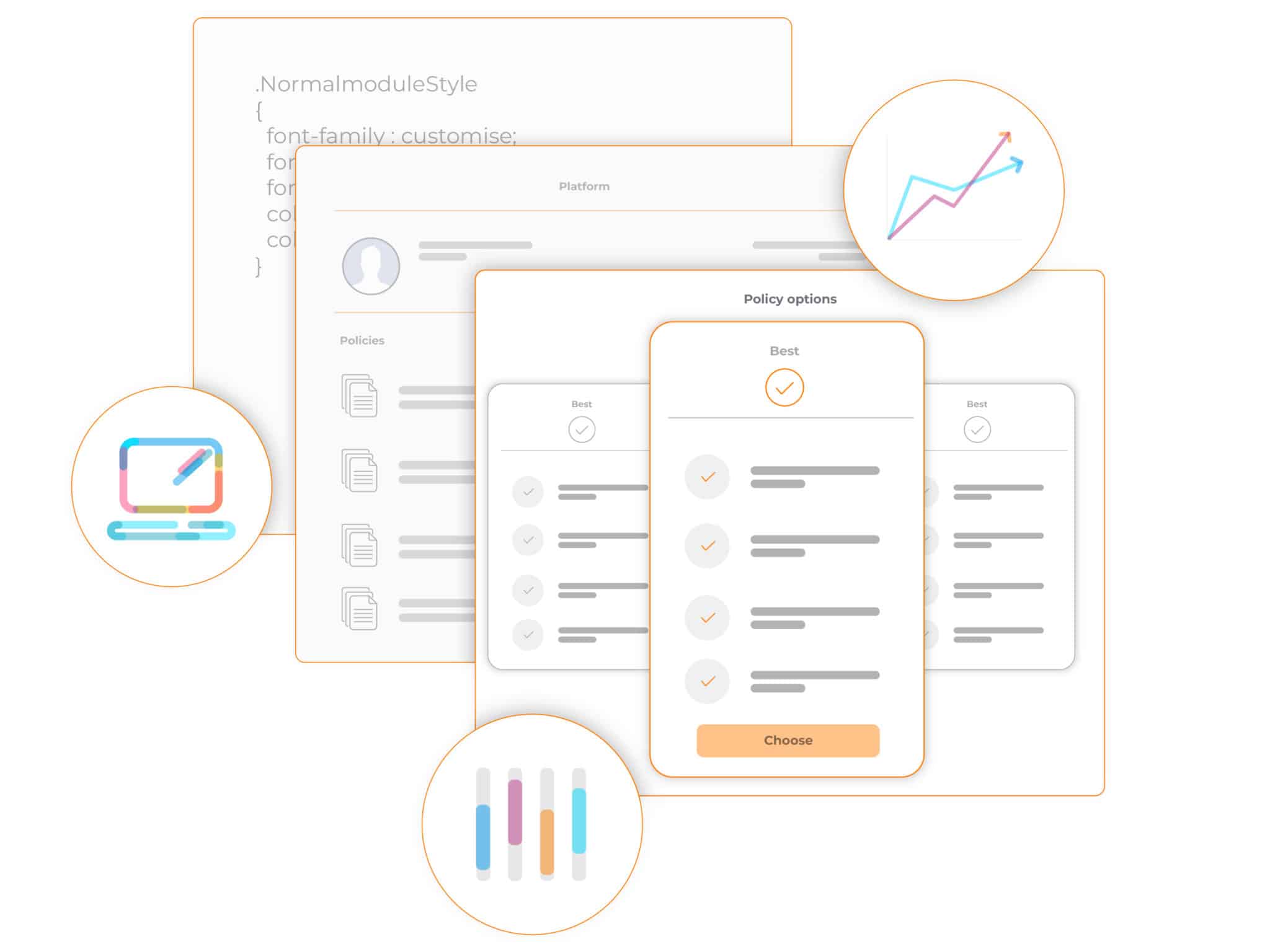

One exciting development is Frontend-as-a-Service (FaaS). Separating the frontend solution from the backend enables insurance firms to transform the experience they deliver to customers independently of the system that manages products and policies.

Not only that, though, they can sell more policies, improve operational efficiency and even learn from user behaviour to bring new products to market faster.

In this article, we explore the problems with traditional web development in the digital age, explain why insurance firms are deploying FaaS solutions, and outline how FaaS works.

The challenges of building on legacy systems in insurance

Rapid technological evolution and the development of API-driven architecture drove many insurance firms to explore system integration. Connecting disparate systems made sense on the surface; the problem was, however, that universal standards needed to be implemented around APIs.

Creating a business case for connecting every new client and system was time-consuming and costly.

Middleware technology was deployed to manage these growing connections between legacy systems and more modern, sophisticated tools. This bloated the tech stack and added complexity, leading to some pretty big problems that will only get worse:

1. Missed sales opportunities

Many legacy user interfaces are no longer fit for purpose. They are long-winded to implement, cumbersome to update, slow to load and typically lead to customers giving up on systems that won’t work on mobile, aren’t accessible and take too long to deliver answers.

Customers expect things to be effortless, seamless and achievable from the palm of their hands. When these expectations aren’t met, they look elsewhere and sales are lost.

On top of these significant challenges, new products require an interface built from scratch.

Building new interfaces is complex, and legacy systems have tricky change and release processes so even small changes take ages.

This lack of speed in bringing products to market costs valuable opportunities to gain a competitive advantage and offer customers bespoke and novel insurance unavailable elsewhere.

To top it off, you can’t easily leverage your analytics data to make tweaks and improvements to service delivery. It amounts to missed sales and frustrated teams grappling with legacy tools.

2. Spiralling costs of bloated systems

Complex codebases make minor fixes expensive to verify. Plus, you depend on keeping the developers who inherently know how the system works. Knowledge transfer is a genuine concern when developers leave.

With more modern systems, developer time is spent much more strategically. Why spend time updating old and complex systems for security enhancements, accessibility or regulatory requirements (potentially large projects) when you don’t need to?

3. Building your own solution takes time (and resource)

To combat these issues, we see insurers building their own solutions. But designing, building and testing new systems are all-encompassing projects. Competing stakeholder goals and resource constraints make them notoriously difficult to deliver.

And you have the repeated overhead for each new product launch, meaning you’re simply kicking the can down the road for a few years until your portfolio expands and complexity and costs pose near-existential threats again.

A Front-End Designed For Insurance Providers

Quickly build and optimise your digital insurance distribution

Welcome to SWIFT, the customisable front-end solution for insurance products that seamlessly integrates into your digital ecosystem.

Get a FREE demo to see SWIFT in action

Book a demoHow Frontend-as-a-Service solutions solve problems for insurers

The use case for modular applications linked together with APIs is much more established in modern businesses. There is clear alignment from all technology providers around their implementation.

Everything is geared towards agility, speed to market and rapid iteration.

APIs are now more RESTful, easier to apply and adopt – there’s an entire ecosystem and recognised best practices that keep organisations focused on collaboration and partnership more than competition.

Open APIs are helping to eradicate the problem of bloating middleware and decouple the tight intertwining of legacy interfaces with the backend solution. They are paving the way for insurance providers to build the tech stack they want.

Frontend-as-a-Service solutions interact directly with your core data systems, such as your Policy Admin, CMS or even your CRM, to streamline operations while surfacing information intelligently for customers to interact with.

Enhance the customer experience

Insurers are now empowered and free to build personalised customer journeys with FaaS. Whatever you want to deliver, you can do it.

Focused solely on your customer-facing touchpoints but connected to your back-office systems, FaaS solutions enable insurers to deliver seamless customer experiences through true agility and responsiveness.

Customers can navigate offerings with ease and understand coverage levels effortlessly. Product changes can be made in real-time, and interactive front ends, complete with calculators and comparison features, empower customers to make better decisions while insurers mitigate potential risks.

FaaS products boast rapid loading times and are responsive or mobile-first, meaning customers don’t have to wait to see quotes or coverage. They can get it wherever they are.

Understanding customer preferences allows insurers to collect enriched data, personalise offerings and even develop new products and services.

Integrate with multiple systems for operational advantage

Most FaaS providers will integrate seamlessly with other tools and systems in your ecosystem. For example, in the insurance sector, insurers could leverage new AI-driven support tools to answer customer queries immediately and even guide users through their applications.

You can connect to Payment Gateways, analytics tools and your marketing tools to streamline, enhance and drive sales through more personalised messages.

Drive cost efficiency and better resource allocation

FaaS solutions are designed to be virtually plug-and-play. With minimal customisation and integration, your frontend is primed and ready to meet the needs of your customers and the business.

Plus with easier to update and manage tools, you can point resources at more pressing challenges and concerns – no more scrabbling for manpower or developer time. And when teams are doing meaningful work adding value to the business, team morale boosts.

Deliver conversions, new products and policies to market faster

Since updates and tweaks are simple to implement, bringing new products and policies to market is accelerated rapidly.

FaaS solutions help you unlock real agility, allowing you to move faster and scale your product offering in response to actual customer demands.

Working in this way, you can quickly learn what works and what doesn’t to improve individual elements, products or services. You can even interact with aggregators to enable rapid response to policy and coverage requests to meet and exceed customer demands.

Watch a FaaS solution in action

Frontend-as-a-Service solutions help insurance firms overcome distribution challenges and build an optimised journey for customers across platforms and devices.

At Softwire, we’ve developed SWIFT, and work with insurance firms to create customisable web front-ends.

Are you ready to take the first step towards delivering quick digital products, boosting customer experiences and hitting sales targets?